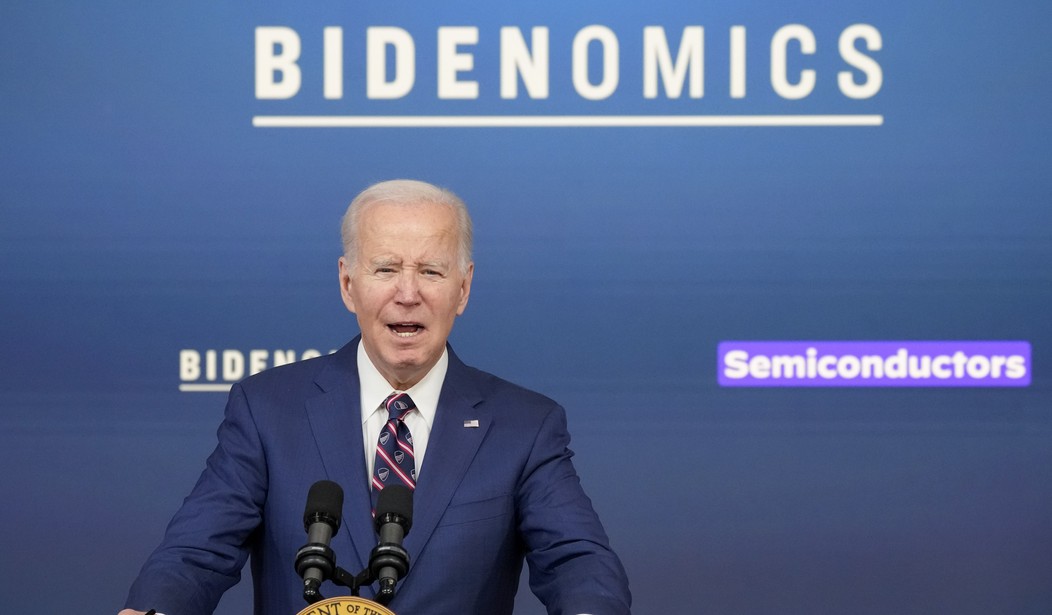

Look, the economy is not great. We all know this, and even the data bears this out: Q1 GDP growth 'cooled sharply'. So we'd think the President would be focused on improving the economy. Instead, Biden's proposed budget includes a proposed 44.6% capital gains tax, and a 25% unrealized capital gains tax.

🇺🇸 President Biden proposes a 44.6% capital gains tax, the highest in history.

— Watcher.Guru (@WatcherGuru) April 24, 2024

The proposal also includes a 25% tax on unrealized gains for high-net-worth individuals. pic.twitter.com/ebiYWfO9Oj

'High-net-worth' individuals are those worth more than $100 million, apparently.

In March, President Biden proposed a 44.6% capital gains tax in the 2025 government budget, the highest in history. The proposal includes a 25% tax on unrealized gains for high-net-worth individuals. A quote from the March budget proposal reads “Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.”

The source of the 44.6% rate is a footnote from the General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals, and it reads in relevant part: “A separate proposal would first raise the top ordinary rate to 39.6 percent … An additional proposal would increase the net investment income tax rate by 1.2 percentage points above $400,000 … Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.” The White House looks for the proposal to raise the long-term capital gains and qualified dividends rates for taxpayers.

Just wow. All your money belongs to Grandpa Joe, apparently.

Of course. How else is he going to afford to bomb children overseas if he can't take more of your money? He could print it but that would destabilize the $ too quickly. Stealing from Americans is a safer bet.

— Jo Jorgensen (@JoForLiberty) April 24, 2024

Recommended

That's precisely what it is: stealing.

And it won't stay limited to 'high-net-worth' individuals. They'll put an 'unrealized' capital gains tax on your house eventually.

Why would you ever vote for anyone who's proposing to increase your cost of living and taxes

— Lord Miles (@real_lord_miles) April 25, 2024

Because he promises free s**t, 'equity', and abortion-on-demand. That's their argument.

And 'Orange Man Bad'. Don't forget that part.

The tax poem. Anonymous pic.twitter.com/9GreCPyl6t

— DG. MD (@rheumatics) April 24, 2024

Nailed it.

taxing unrealized gains lmaoo

— KBB (@KingBlackBored) April 24, 2024

Laugh, but he's serious.

A tax on unrealized gains is like a tax on unsold animals.

— Mixy Pisa (@MixyPisa) April 25, 2024

You raise a cow from a calf, the government notices, and takes 25% of the cow.

This kills the cow, but that's your problem. https://t.co/ZivE7NVeeX

Yep.

It’s difficult to describe how insane a 25% tax on unrealized capital gains is.

— Austen Allred (@Austen) April 24, 2024

Not a one-time 25% hit. It’s compounding, annually taking 25% of every dollar of potential increase before it can grow.

Not an exaggeration to say it could single-handedly crush the economy. https://t.co/0rkrXuA1AW

It would. But crushing the economy is the point.

Taxes on unrealized capital gains is the most absurd galaxy brain idea ever conceived pic.twitter.com/287ipaOGpJ

— Mike Beckham (@mikebeckhamsm) April 24, 2024

Commies are the ultimate galaxy brains.

Let’s say you build a business from scratch and qualify for Biden’s new 25% unrealized gains tax. So you have to sell 25% of your business to pay the tax. But now you have to pay 44.6% cap gains + 13.3% CA on that. So you actually have to sell ~37%. Is this right?

— David Sacks (@DavidSacks) April 25, 2024

Sounds about right.

Start with $1 million in unrealized gains.

— Death's Guinea Pig 5.0 🟦 (@MakiTheFeral) April 25, 2024

Year:

1 - pay 250k on $1 million

2 - pay 187.5k on remaining $750k

3 - pay 141k on remaining $563k

4 - pay 106k on remaining $422k

CONGRATULATIONS! YOUR GOVERNMENT HAS STOLEN 2/3 OF YOUR BUSINESS IN JUST 4 YEARS!

Remember: Obama said you didn't build that, anyway.

Now the good news is a president's proposed budget rarely survives the budget debate and process. Here's hoping this insane proposal ends up on the scrap heap.

Join the conversation as a VIP Member